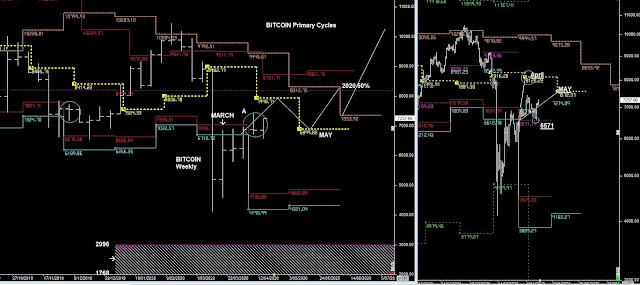

BITCOIN PRIMARY & WEEKLY CYCLES

We're all presuming the BITCOIN is going much higher, therefore you want to be BUYING the DIPS

Those DIPS will always be the YELLOW LEVELS in the monthly time frames. (1st May 2020)

BITCOIN is above the Primary 50% level at 8225 (BULL TREND)

This Week finally hit 8846 and the BUY YELLOW Zone.

If BITCOIN is going to go higher, it needs to move back above the JULY level of 9353 and continue higher

However, we are in a similar position as MARCH and the last major sell off; the start of the next month opens be below the Monthly 50% level.

BITCOIN MONTHLY

1. A bullish pattern would continue higher from last week's lows at 8846 and close above 9437 by the end of the week

2. or a move down into the July monthly low around 8670 and then go moves higher over the next 5- 8 days

BEARS

Bearish pattern would be a failure at 9353 and close below 8670

Lower Support levels - 7670 (Brown)

5670 - Monthly Channel lows (Red)

Collapse - 900 (Green)

ETHEREUM Primary & Monthly Cycles

Same as BITCOIN, above the 2020 50% level at $200.50

Was looking good until late last week and likely to open below the July 50% level in a couple of days at $231

Not looking good below $213 (July Lows)