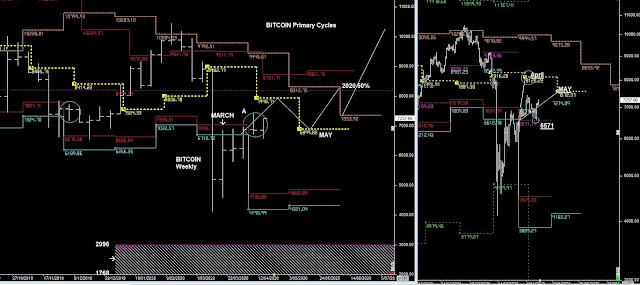

Bitcoin Primary

& Weekly Cycles

BITCOIN has been following the price action in the

Index markets closely, and if you read my latest on the S&P and my view

that it's heading lower, then BITCOIN might follow and continue lower.

However, unless it's below 6571, then it's up, but

I wouldn't be surprise if it tests 6571 this week.

We saw the break on

Friday and now Bitcoin is looking to move back towards 6571.

Is my original view of

Bitcoin moving down into the April lows in the week of 20th – 24th

still in play?

As part of the break

and extend pattern in the Monthly cycles

We have a very similar

price pattern, as last November/December. The first week has a

‘NO-CONTROL” bar,

where the Weekly close is the same as the open.

4 days ago I didn’t

think so, now it is certainly a possibility.

ETHEREUM PRIMARY & WEEKLY CYCLES

Ethereum Primary

& Weekly Cycles

Too early to tell on

what’s going to happen, but if it’s following Break and extend pattern in the

monthly Cycles, then you want to be buying around the Yearly lows. AT 68.00

If it’s not going

lower, then 147 is the support zone in the weekly cycles.

XRP PRIMARY & WEEKLY CYCLES

XRP has already

tested the Yearly lows in 2020 and if it’s going to continue higher, then it

should push up next week from .1868 to .2457.

However, if there’s a

lot of selling happening in the next 10-days, then it could end up as low as

.0966cents